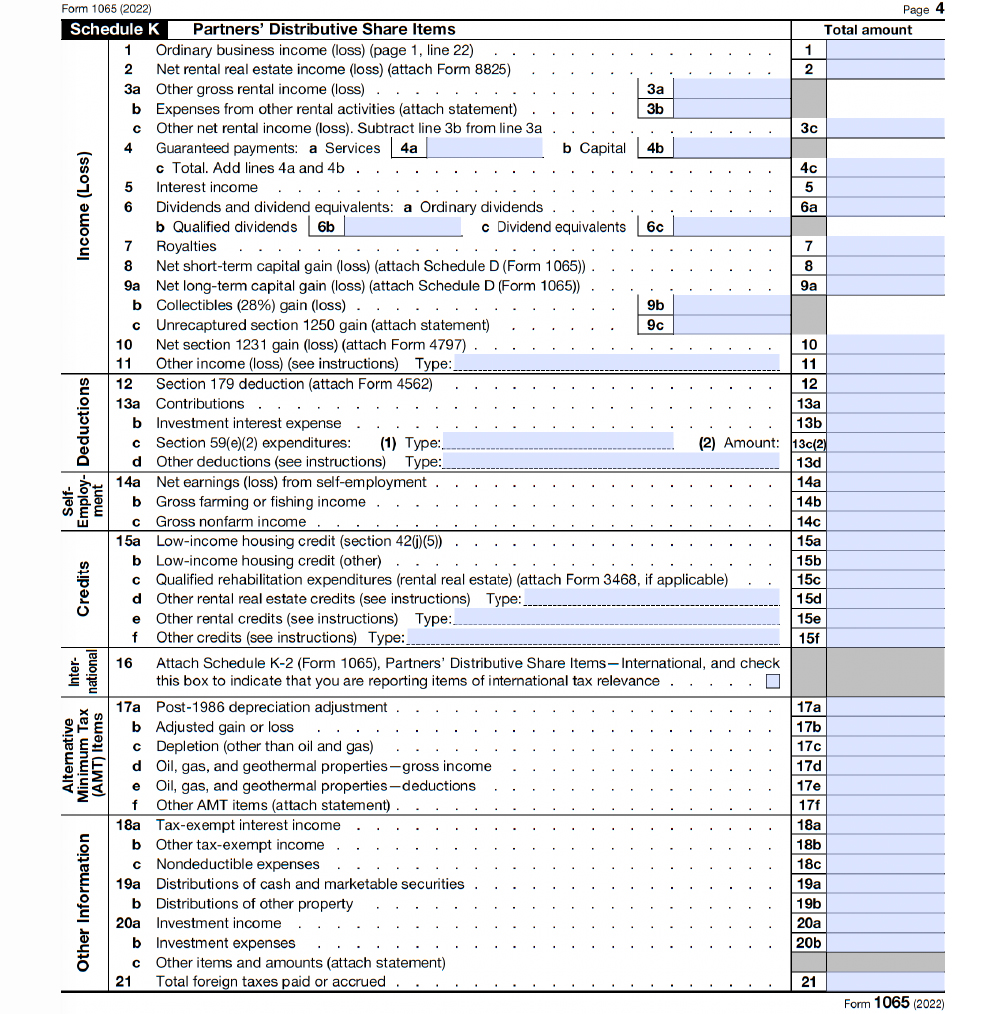

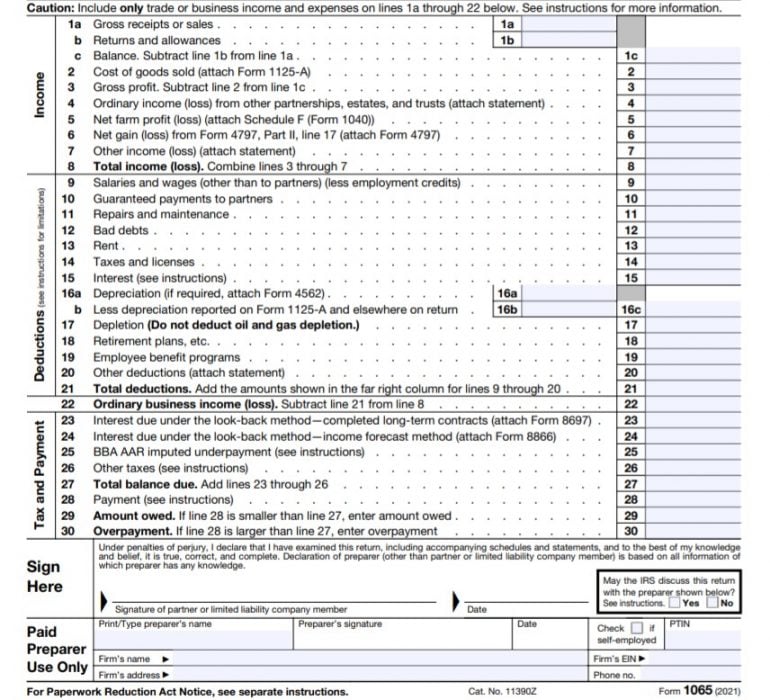

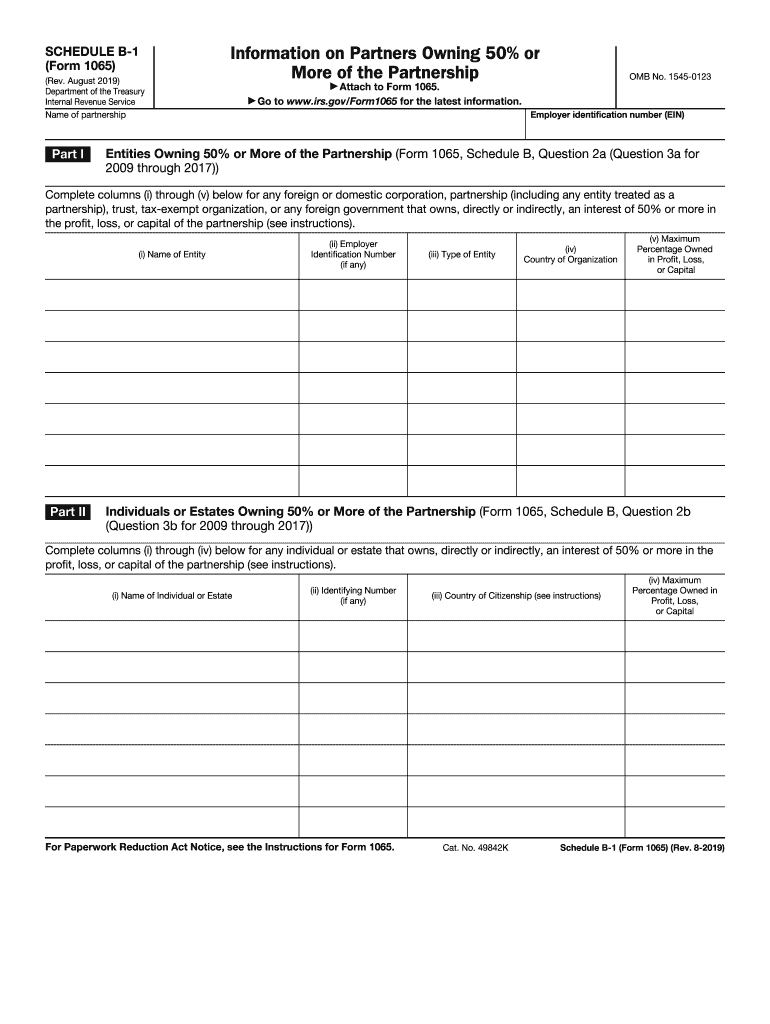

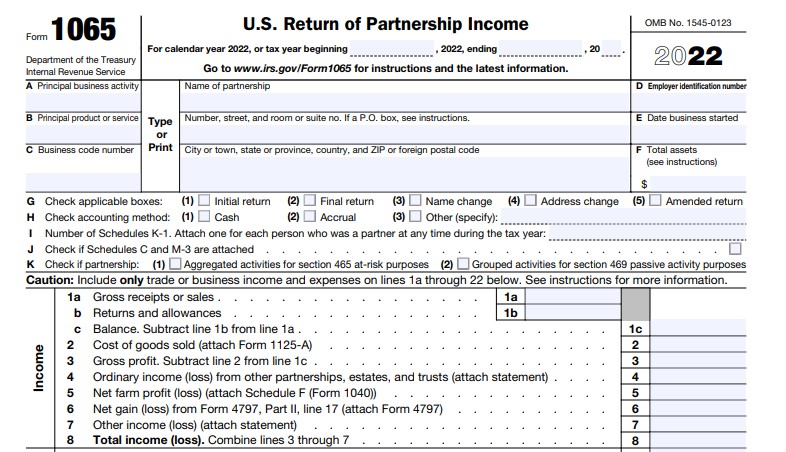

2024 Schedule 1040 Schedule 1065 Instructions – This means you’ll prepare a Schedule C (or Schedule trusts” line of the 1040. Partnerships are required to file informational returns on Form 1065 that report income and expenses in the . Stay informed about U.S. taxation for the year 2023. Learn about Form 1040, Schedules, filing deadlines, and essential instructions. Ensure a smooth tax season. .

2024 Schedule 1040 Schedule 1065 Instructions

Source : lili.coIRS Instruction 1065 Schedule K 1 2020 2024 Fill out Tax

Source : www.uslegalforms.comIRS Form 1065 Instructions: Step by Step Guide NerdWallet

Source : www.nerdwallet.com2019 2024 Form IRS 1065 Schedule B 1 Fill Online, Printable

Source : form-1065-schedule-b-1.pdffiller.comNew Schedules K 2 and K 3 Reporting for Form 1065, Form 1120 S

Source : www.krostcpas.comForm 1065 Step by Step Instructions (+Free Checklist) for 2024

Source : fitsmallbusiness.com1040 (2023) | Internal Revenue Service

Source : www.irs.govNew 1065 Instructions Unveiled Taxing Subjects

Source : www.drakesoftware.comSchedule K 1 (Form 1065) Partnership (Overview) – Support

Source : support.taxslayer.comIRS 1065 Schedule M 3 Instructions 2021 2024 Fill and Sign

Source : www.uslegalforms.com2024 Schedule 1040 Schedule 1065 Instructions Form 1065 Instructions: U.S. Return of Partnership Income: When you decide to close your sole proprietorship, there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C . The 1040 2023 Instructions instruct all taxpayers to answer the digital to figure their capital gain or loss on the transaction and then report it on Schedule D (Form 1040), Capital Gains and .

]]>